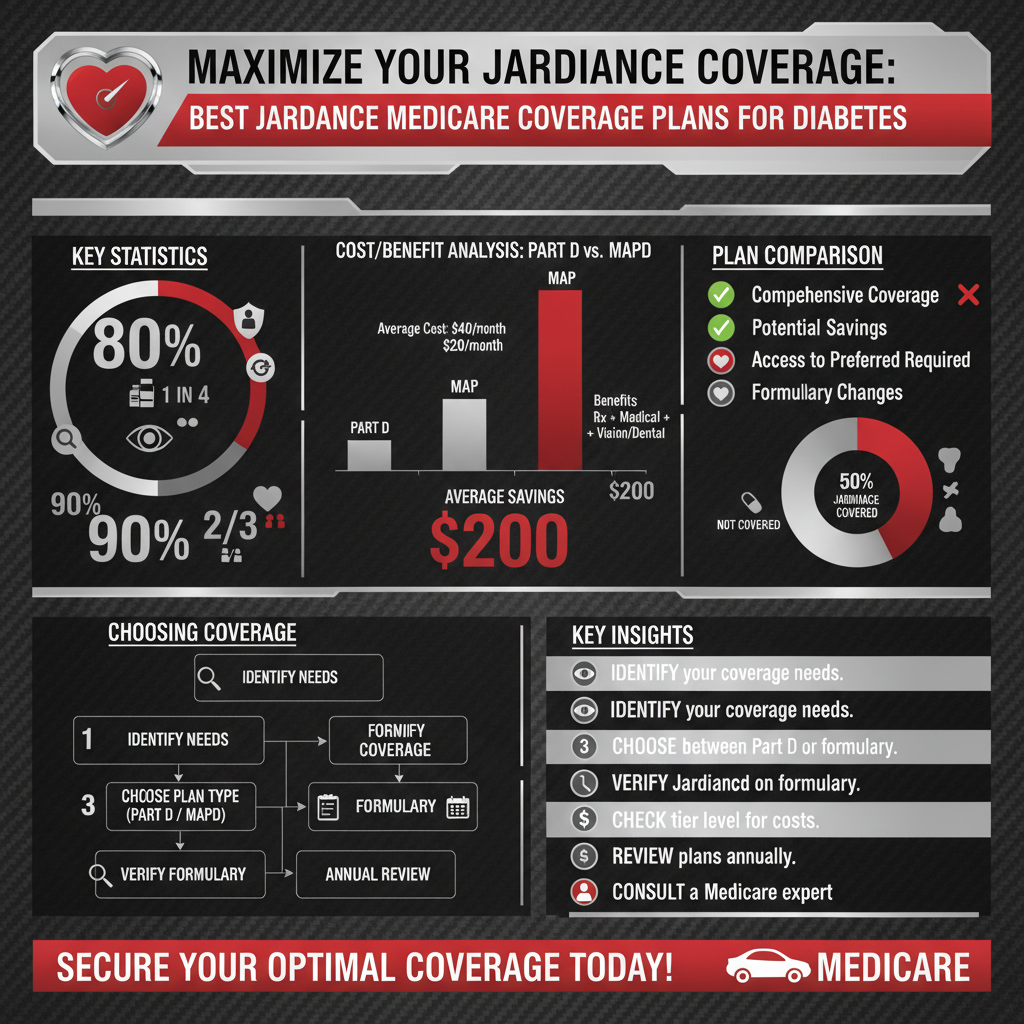

For comprehensive Jardiance coverage under Medicare, beneficiaries with diabetes should primarily consider Medicare Part D (Prescription Drug Plans) or Medicare Advantage Plans (Part C) that include prescription drug coverage (MAPD). These plans vary significantly in cost-sharing, formularies, and specific drug tiers, making it crucial to compare options annually to find the “best” plan for your individual needs. This guide will walk you through understanding your choices and securing optimal coverage for Jardiance.

Understanding Jardiance and Medicare Drug Coverage

Managing type 2 diabetes effectively often involves a combination of lifestyle changes and carefully selected medications. Jardiance (empagliflozin) is a crucial medication in this fight, playing a significant role in helping adults with type 2 diabetes improve blood sugar control. Beyond its primary function, Jardiance is also celebrated for its proven cardiovascular benefits, reducing the risk of cardiovascular death in adults with type 2 diabetes and established cardiovascular disease, and lowering the risk of hospitalization for heart failure. Given its importance, ensuring consistent and affordable access to Jardiance is a top priority for many Medicare beneficiaries.

However, navigating Medicare’s prescription drug coverage can sometimes feel like a maze. It’s important to understand that Original Medicare, which consists of Part A (hospital insurance) and Part B (medical insurance), generally does not cover outpatient prescription drugs like Jardiance. While Part B might cover some specific drugs administered in a doctor’s office or hospital outpatient setting, daily medications you pick up at a pharmacy are not included. Therefore, to receive coverage for Jardiance, you absolutely must enroll in a separate Medicare prescription drug plan. This often means looking at either a standalone Part D plan or a Medicare Advantage plan that bundles drug coverage.

Medicare Part D: Standalone Coverage for Jardiance

Medicare Part D plans are specifically designed to provide outpatient prescription drug coverage and are offered by private insurance companies that have contracts with Medicare. These plans work alongside Original Medicare (Parts A & B) to give you a complete benefits package. If you choose to stick with Original Medicare for your medical and hospital needs, a standalone Part D plan is your go-to option for Jardiance coverage.

A critical aspect of any Part D plan is its formulary, which is the plan’s list of covered drugs. Before enrolling, it’s absolutely essential to ensure that Jardiance is explicitly listed on the formulary. Not all plans cover every drug, and formularies can change each year. Once you confirm Jardiance is on the list, you’ll want to check its assigned tier level. Medications are categorized into different tiers, with lower tiers typically including preferred generics and preferred brands, while higher tiers often include non-preferred brands and specialty drugs. Jardiance, as a brand-name medication, will likely be in a higher tier, which directly impacts your out-of-pocket costs, usually meaning a higher co-pay or co-insurance.

Beyond the formulary and tiers, it’s vital to be aware of other plan specifics that can affect your expenses throughout the year. Most Part D plans have an annual deductible, which you must pay out-of-pocket before the plan starts to cover your drug costs. After meeting your deductible, you’ll typically pay co-pays (a fixed dollar amount) or co-insurance (a percentage of the drug cost) for your medications. Many plans also include a “coverage gap” or “donut hole,” a temporary limit on what the drug plan will pay for drugs. While discounts are applied to many brand-name drugs in this phase, it can still lead to higher costs until you reach the catastrophic coverage phase, where you pay a much smaller co-insurance or co-pay for covered drugs for the rest of the year. Understanding these phases is key to budgeting for your Jardiance expenses.

Medicare Advantage (Part C) Plans and Jardiance

Medicare Advantage Plans, often referred to as Part C, offer an alternative way to receive your Medicare benefits. These plans are also offered by private insurance companies approved by Medicare and essentially “replace” Original Medicare. Many Medicare Advantage Plans, known as MAPD plans, combine your hospital (Part A), medical (Part B), and prescription drug coverage (Part D) into a single, comprehensive plan. This can simplify your healthcare management, as you’re dealing with just one insurance company for most of your medical and drug needs.

Just like standalone Part D plans, MAPD plans have their own formularies and cost-sharing structures. These might differ significantly from those found in standalone Part D plans, so it’s always worth comparing them side-by-side if you’re considering both options. You’ll still need to verify that Jardiance is on the plan’s formulary and note its tier level to understand your potential co-pays or co-insurance.

One of the big draws of MAPD plans is the potential for integrated benefits. They often include additional perks that Original Medicare doesn’t, such as dental, vision, hearing, and even gym memberships, which can add significant value. While these integrated benefits and potentially lower overall out-of-pocket costs can be very appealing, it’s important to be mindful of network restrictions. Most Medicare Advantage Plans operate within specific provider networks (HMOs or PPOs), meaning you might need to use doctors, hospitals, and pharmacies that are part of the plan’s network to get the most coverage. If you have preferred doctors or a long-standing pharmacy, ensure they are in the plan’s network before enrolling to avoid higher out-of-network costs.

Key Factors When Comparing Jardiance Coverage

Choosing the “best” Medicare plan for Jardiance isn’t a one-size-fits-all situation; it’s a highly personal decision based on your unique health needs, financial situation, and preferences. Here are the key factors you absolutely must consider when comparing plans:

* Formulary Inclusion and Tier: This is your first and most important step. Don’t assume any plan will cover Jardiance. You must confirm that Jardiance is listed on the plan’s formulary. Once confirmed, identify its specific drug tier. As a brand-name medication, Jardiance is usually placed in a higher tier (e.g., Tier 3 or 4 for non-preferred brand or specialty drugs), which typically involves higher co-payments or co-insurance compared to generic or preferred brand drugs. Some plans might even categorize it as a “specialty drug,” which could have different cost structures. Always look for a plan where Jardiance is at the most favorable tier possible, reducing your per-prescription cost.

* Total Estimated Costs: Looking solely at the monthly premium can be misleading. You need to evaluate the entire financial picture to understand your potential annual expenses. This includes the plan’s premium (the monthly fee you pay to be enrolled), any annual deductible for prescription drugs (which you pay before coverage kicks in), the co-pays or co-insurance specifically for Jardiance (and any other medications you take), and the annual out-of-pocket maximum. The out-of-pocket maximum is a crucial safety net, as it’s the most you’ll pay for covered services in a year before your plan pays 100%. Factor in the “coverage gap” (donut hole) and how it might affect your costs for Jardiance throughout the year. Use the Medicare Plan Finder tool (more on that below) to get personalized cost estimates based on all your medications.

* Pharmacy Network: Convenience and cost-savings often go hand-in-hand with your pharmacy choice. Verify that your preferred pharmacy—whether it’s a local independent store, a major chain, or a mail-order service—is part of the plan’s network. Many plans have “preferred pharmacies” that offer medications at a lower co-pay or co-insurance. Exploring these preferred pharmacies could lead to significant savings on your Jardiance prescriptions. Conversely, using an out-of-network pharmacy could result in much higher costs or no coverage at all.

Navigating Enrollment and Expert Assistance

The process of enrolling in a Medicare prescription drug plan or Medicare Advantage plan can seem daunting, but thankfully, there are excellent resources available to guide you.

Your absolute best tool for comparing plans is the official Medicare Plan Finder tool, available on Medicare.gov. This user-friendly online resource allows you to enter your specific medications (including Jardiance) and dosages, your preferred pharmacies, and your zip code. It then provides a personalized list of all available plans in your area, showing estimated annual costs, including premiums, deductibles, and projected out-of-pocket expenses for your specific drugs. The most crucial time to use this tool is during the Annual Enrollment Period (AEP), which runs from October 15 to December 7 each year. This is when you can join, switch, or drop a Medicare health or drug plan, with coverage effective January 1st of the following year. Even if you’re happy with your current plan, it’s wise to review your options annually during AEP, as plan benefits and costs can change.

For personalized guidance and expert assistance, consider reaching out to State Health Insurance Assistance Programs (SHIPs). These are free, unbiased counseling services available in every state, staffed by trained volunteers who can help you understand your Medicare options, compare plans, and navigate the enrollment process. They don’t represent any insurance company, so their advice is purely focused on your best interests. Additionally, licensed insurance brokers who specialize in Medicare plans can also provide valuable insights. While brokers represent insurance companies, a good broker will listen to your needs and help you find a plan that fits, often at no direct cost to you.

Remember, your plan choice isn’t set in stone forever. Reviewing your plan annually is a smart strategy. Formularies can change, drug tiers can shift, and premiums and cost-sharing amounts often adjust each year. A plan that was perfect for your Jardiance coverage one year might not be the most cost-effective option the next. Staying informed ensures you always have the best possible coverage.

Strategies to Maximize Jardiance Savings

Even with robust Medicare coverage, the cost of brand-name medications like Jardiance can still be substantial. Fortunately, several strategies can help you maximize your savings and keep your out-of-pocket expenses manageable.

One excellent avenue to explore is manufacturer patient assistance programs or discount coupons. Pharmaceutical companies often offer programs designed to help patients afford their medications, especially high-cost brand-name drugs. For Jardiance, you can typically find information about these programs directly on the manufacturer’s official website or by speaking with your doctor or pharmacist. These programs might offer co-pay cards, financial assistance, or even provide the medication for free to eligible individuals who meet certain income or insurance criteria. Taking a few minutes to investigate these options could lead to significant savings.

Another practical strategy involves checking if your chosen Medicare plan offers mail-order pharmacy benefits. Many Part D and Medicare Advantage plans encourage the use of mail-order pharmacies, especially for maintenance medications like Jardiance that you take regularly. Mail-order services can often provide a 90-day supply of your medication, sometimes at a lower co-pay or co-insurance compared to filling a 30-day supply at a retail pharmacy. Beyond the potential cost advantages, mail-order delivery also offers convenience, ensuring your medication arrives right at your doorstep.

Finally, determine if you qualify for Medicare’s Extra Help program, also known as the Low-Income Subsidy (LIS). This vital program is designed to significantly reduce prescription drug costs for eligible individuals with limited income and resources. If you qualify for Extra Help, Medicare will help pay for your monthly premiums, deductibles, and co-payments for your Part D plan, potentially lowering your out-of-pocket cost for Jardiance to just a few dollars. Eligibility for Extra Help is typically based on your income and assets, and you can apply through the Social Security Administration. It’s a lifesaver for many beneficiaries struggling with drug costs, so don’t hesitate to check if you qualify.

To summarize, finding the best Medicare coverage for Jardiance for diabetes involves carefully evaluating Medicare Part D or Medicare Advantage plans with drug coverage. The “best” plan is highly individual, depending on your specific needs, other medications, and financial situation. By understanding formularies, comparing costs, and utilizing available resources like Medicare.gov, you can make an informed decision to ensure affordable and consistent access to your Jardiance medication. Don’t wait; start reviewing your options today to secure the coverage that works best for you and helps you manage your diabetes with confidence.

Frequently Asked Questions

What type of Medicare plan covers Jardiance for diabetes management?

Jardiance, as a prescription medication for managing type 2 diabetes, is primarily covered under Medicare Part D, which is Medicare’s prescription drug benefit. You can obtain Part D coverage either through a standalone Medicare Prescription Drug Plan (PDP) that complements Original Medicare (Parts A and B), or through a Medicare Advantage Plan (Part C) that includes prescription drug coverage (MAPD). It’s crucial to consult the specific plan’s formulary, which lists covered medications, to confirm Jardiance’s inclusion and its designated cost-sharing tier.

How can I find a Medicare Part D or Advantage plan that specifically covers Jardiance for my diabetes?

To effectively find a Medicare plan covering Jardiance, you should utilize the official Medicare Plan Finder tool on Medicare.gov during the annual enrollment period (or a Special Enrollment Period if you qualify). Input your specific medications, including Jardiance, along with your preferred pharmacy, and the tool will display plans in your service area that cover your prescriptions, providing estimated out-of-pocket costs. Comparing formularies and the cost-sharing details for Jardiance across various available plans is essential for informed decision-making regarding your diabetes care.

Why is comparing different Medicare plans for Jardiance coverage so important, and what factors should I consider?

Comparing Medicare plans for Jardiance coverage is critical because formularies, deductibles, and out-of-pocket costs for prescription drugs vary significantly among plans, directly impacting your diabetes treatment expenses. Key factors to evaluate include whether Jardiance is listed on the plan’s formulary and its drug tier (which influences your copay or coinsurance), the plan’s overall premium, any deductible that applies to prescription drugs, and whether your preferred pharmacy is in the plan’s network. Additionally, consider the plan’s overall annual out-of-pocket maximum to understand your potential total costs for managing diabetes.

Which Medicare plans generally offer the best coverage for high-cost diabetes medications like Jardiance?

Generally, Medicare plans that offer lower deductibles, more favorable copayments for Tier 3 or Tier 4 drugs (where high-cost medications like Jardiance often reside), or those that provide additional gap coverage can offer better value for high-cost diabetes medications. Some Medicare Advantage plans might also include supplementary benefits or a lower premium if you’re comfortable with a specific provider network. The “best” plan isn’t universal; it depends on your individual health needs, financial situation, and how well the plan’s formulary and cost structure align with your Jardiance prescription and overall diabetes management.

What are the potential out-of-pocket costs for Jardiance with Medicare, and how can I minimize them?

Potential out-of-pocket costs for Jardiance with Medicare can encompass monthly premiums, deductibles, copayments, and coinsurance, particularly if you enter the coverage gap (also known as the “donut hole”). To minimize these costs, ensure Jardiance is on your chosen plan’s formulary at the lowest possible tier, as lower tiers generally have lower copays. Additionally, investigate if you qualify for Medicare’s Extra Help program, which significantly reduces prescription drug costs, or look into manufacturer patient assistance programs specifically for Jardiance. Regularly reviewing and comparing Medicare plans during open enrollment can also help you find the most cost-effective coverage for your diabetes medication needs.

References

- https://www.medicare.gov/drug-coverage-information/how-medicare-drug-plans-work

- https://www.medicare.gov/drug-coverage-information/find-a-medicare-drug-plan

- https://www.medicare.gov/basics/costs/medicare-costs/part-d-costs

- https://www.kff.org/medicare/fact-sheet/medicare-part-d-a-primer/

- Diabetes – NIDDK

- https://www.fda.gov/drugs/drug-approvals-and-databases/drug-details?drugid=J7C7XQ6R2Z

- https://www.aarp.org/health/medicare-insurance/info-2023/part-d-drug-coverage-guide.html

- https://diabetesjournals.org/care/article/47/Supplement_1/S168/153926/8-Pharmacologic-Approaches-to-Glycemic

- https://www.ncoa.org/adviser/medicare/medicare-part-d/